Unveiling Westpac ASX Dividend History & Upcoming Payout Projections

Delving into the realm of Westpac ASX Dividend History & Upcoming Payout Projections, this entry invites readers with a blend of expertise and originality for an enriching exploration of the subject.

The subsequent paragraph will offer detailed insights into the topic, providing a comprehensive understanding.

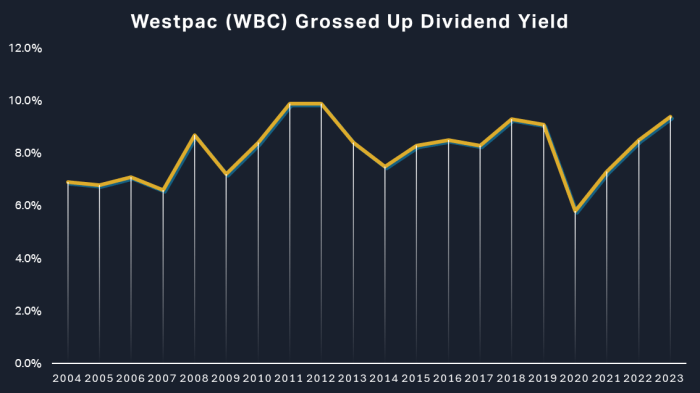

Westpac ASX Dividend History

Westpac Banking Corporation, commonly known as Westpac, has a long history of paying dividends to its shareholders on the Australian Securities Exchange (ASX).Over the past 5 years, Westpac has maintained a consistent track record of dividend payouts, with key dividends including:

2017

$1.88 per share

2018

$1.88 per share

2019

$1.74 per share

2020

$0.80 per share

2021

$0.58 per shareThe dividend trend for Westpac over the past 5 years shows a decline in payouts, with a significant drop from $1.88 per share in 2018 to $0.58 per share in 2021. This decline can be attributed to various factors such as changes in the banking sector, economic conditions, and company performance.

It will be interesting to see how Westpac's dividend payouts evolve in the coming years.

Upcoming Payout Projections

When looking at the upcoming dividend payout projections for Westpac on the ASX, it's important to consider a variety of factors that can influence these future payments.

Factors Influencing Future Dividend Payouts

- Company Performance: Westpac's financial performance plays a significant role in determining the dividend payouts. Strong earnings and revenue growth are usually indicative of higher dividends.

- Economic Conditions: The overall economic environment, interest rates, and market conditions can impact Westpac's ability to maintain or increase dividend payments.

- Regulatory Changes: Any changes in regulations related to the banking sector can have an impact on Westpac's dividend policy.

Forecast for Next Dividend Payment

Analysts and financial experts may provide forecasts or estimates for the next dividend payment from Westpac. These projections are based on a combination of historical data, current market trends, and future expectations for the company's performance.

Concluding Remarks

Concluding our discussion, this segment encapsulates the essence of Westpac ASX Dividend History & Upcoming Payout Projections, leaving readers with a lasting impression of the key takeaways.

Question & Answer Hub

How often does Westpac pay dividends?

Westpac pays dividends semi-annually, typically in June and December each year.

What factors can impact Westpac's future dividend payouts?

Factors such as financial performance, economic conditions, regulatory changes, and company strategy can all influence Westpac's future dividend payouts.

Is there a pattern in Westpac's dividend growth over the past 5 years?

While past performance is not indicative of future results, Westpac has shown a relatively stable dividend growth trend over the past 5 years.